Debt ceiling, OPEC+ meeting, and Evergrande.

Clock ticking

While almost nobody on Wall Street or in Washington expects the U.S. to default this month, the lack of progress on the issue in Congress is starting to make nerves fray. Republicans are trying to force Democrats in the Senate to use a convoluted budgetary process to boost the limit, but experts say that could take two weeks, making today the last day it could begin to be completed in time for Treasury Secretary Janet Yellen’s Oct. 18 deadline. Even the date of default is uncertain, with Yellen herself saying there may be a few days of room and Congressional Budget Office last week suggesting it may not be until November.

Supply

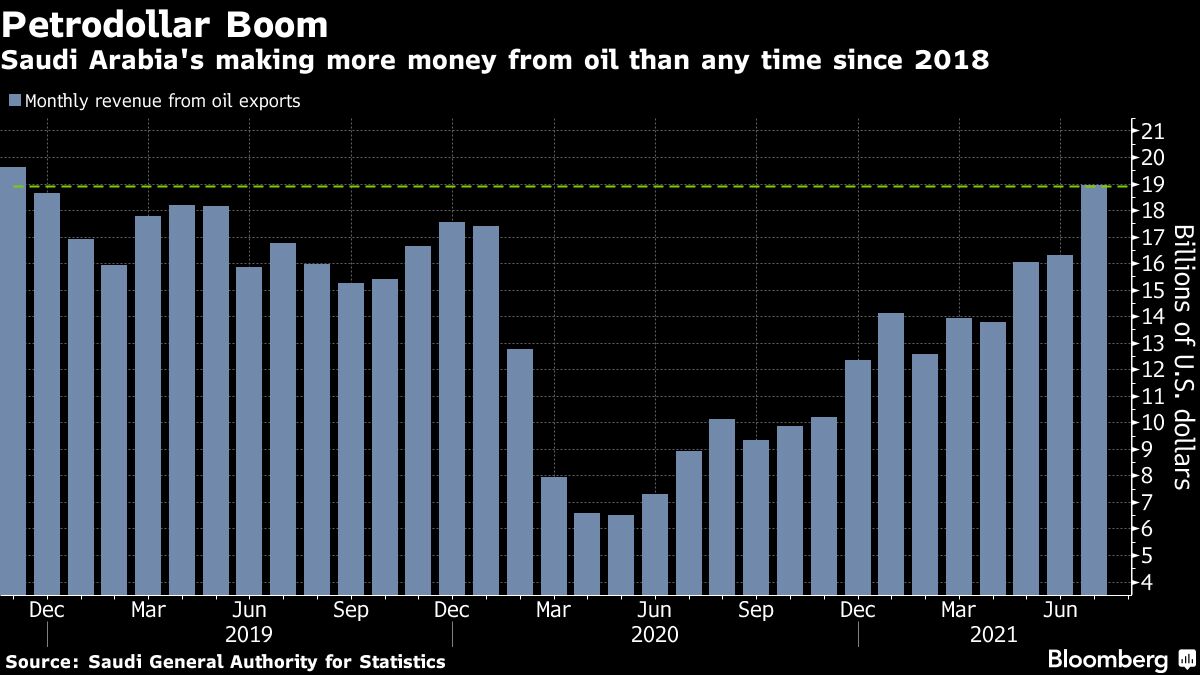

The return of demand for oil and gas due to usual seasonal factors just as economies reopen has sent energy prices sharply higher. That’s the backdrop for today’s meeting of OPEC and its allies where the group is expected to stick to the plan of raising production by 400,000 barrels a day. With the price of international benchmark Brent holding near three-year highs producers are having a very good month, but are coming under increasing pressure from consuming nations, including the U.S., to stop the price of crude rising too high.

Suspended

Shares in China Evergrande Group and its property management unit were halted as it was announced Guangdong-based Hopson Development would

buy a controlling stake in the company’s property services business. Evergrande’s problems are far from over, with payment due today on a $260 million note which has no grace period meaning a failure to pay would trigger default. Authorities in China, however, seem to be more concerned with ring-fencing Evergrande to avoid contagion than they are with making sure bondholders get paid.Markets mixed

Global equity traders remain cautious in the face of climbing inflation and growth concerns while they wait for key data later this week. Overnight the MSCI Asia Pacific Index slipped 0.5% while Japan’s Topix index closed down 0.6%. In Europe the Stoxx 600 Index reversed early-session losses to trade broadly unchanged by 5:50 a.m. Eastern Time with defensive stocks the best performers. S&P 500 futures pointed to a small drop at the open, the 10-year Treasury yield was at 1.491% and gold was lower.

Coming up...

U.S. factory and durable goods orders for August at at 10:00 a.m. St. Louis Fed President James Bullard is today’s sole Fed speaker. President Joe Biden will be in Congress to speak to Democrats on the debt ceiling. The U.S. Supreme Court starts its new term.

What we've been reading

Here's what caught our eye over the weekend.

And finally, here’s what Joe’s interested in this morning

I've been interested in the idea of minting a trillion dollar coin for over a decade now, and for the most part I've believed that it's a legal emergency fix to a failure to raise the debt ceiling. Basically if things are coming down to the wire, and the alternative is default, then it makes sense for the Treasury secretary to use a strained reading of an obscure provision in a 1996 law, allowing for wide latitude in the creation of platinum coins as needed to pay the bills.

In the latest episode of the Odd Lots podcast, we spoke with law professor Rohan Grey, who has written the preeminent legal paper on the coin.

Among the things we discussed:

-- What the law's actual intent was

-- Why the debt ceiling even exists

-- The history and economics of the U.S. Mint-- The U.S. tradition of seignorage revenue from coinage

-- The economics and political aspects of such a move, and much more.

Basically, I no longer think the idea of minting the coin is some wild stretch of the law's intent or language, only to be used in some extreme emergency. Instead, Rohan makes a convincing case that while seemingly unusual, the coin idea fits nicely into the broad aims of the law and the long tradition of money creation in the U.S. Definitely worth a listen. Find it here on Apple.

Follow Bloomberg's Joe Weisenthal on Twitter at @TheStalwart

Like Bloomberg's Five Things? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close.

"start" - Google News

October 04, 2021 at 05:33PM

https://ift.tt/3mku49P

Five Things You Need to Know to Start Your Day - Bloomberg

"start" - Google News

https://ift.tt/2yVRai7

https://ift.tt/2WhNuz0

Bagikan Berita Ini

0 Response to "Five Things You Need to Know to Start Your Day - Bloomberg"

Post a Comment