Washington — The Federal Reserve signaled Wednesday that it may start raising its benchmark interest rate sometime next year, earlier than it envisioned three months ago and a sign that it's concerned that high inflation pressures may persist.

In its latest policy statement, the Fed also said it will likely begin slowing the pace of its monthly bond purchases later this year if the economy keeps improving. The bond purchases have been intended to lower longer-term loan rates to encourage borrowing and spending.

Taken together, the Fed's plans reflect its belief that the economy has recovered sufficiently from the pandemic recession for it to soon begin dialing back the extraordinary support it provided after the coronavirus paralyzed the economy 18 months ago. As the economy has steadily strengthened, inflation has also accelerated to a three-decade high, heightening the pressure on the Fed to pull back.

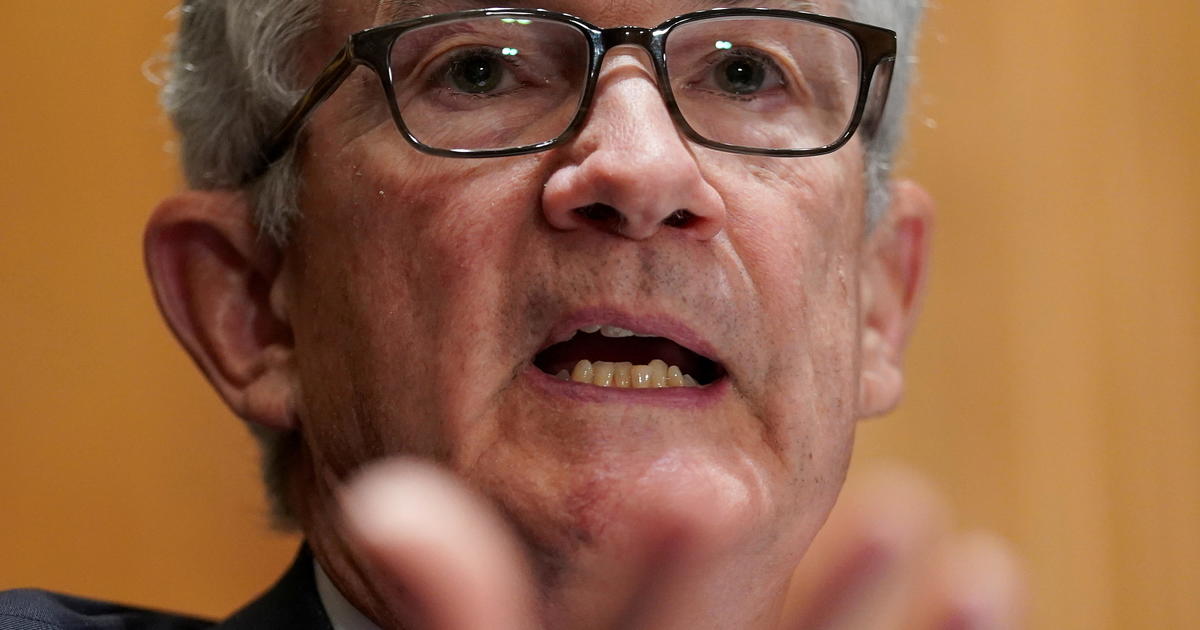

"I think if the economy continues to progress broadly in line with expectations... we can easily move ahead at the next meeting" in November, Jerome Powell said in a press conference,

Still, a move by the central bank to start "tapering" its monetary support for the economy would not signal an imminent hike in interest rates, Powell said.

In their updated quarterly projections, Fed officials now expect to raise their key short term rate once in 2022, three times in 2023 — one more than they had projected in June — and three times in 2024. That benchmark rate, which influences many consumer and business loans, has remained near zero since March 2020, when the pandemic erupted.

"This seems to confirm expectations that they will taper asset purchases in November and do not see the rise in Covid-19 cases as a reason to delay," Brian Coulton, chief economist at Fitch Ratings, said in an analysis. "There has been a very substantial upward revision to their near-term inflation forecasts and inflation is now described as 'elevated'."

Latest COVID-19 wave hindering recovery

"With progress on vaccinations and strong policy support, indicators of economic activity and employment have continued to strengthen," the Federal Open Market Committee, the central bank's interest rate-setting panel, said in its statement. "The sectors most adversely affected by the pandemic have improved in recent months, but the rise in COVID-19 cases has slowed their recovery."

The economy has recovered faster than many economists had expected, though growth has slowed recently as COVID-19 cases have spiked and labor and supply shortages have hampered manufacturing, construction and some other sectors. The U.S. economy has returned to its pre-pandemic size and is thought to be growing at a solid 4% annual rate in the current July-September quarter.

Fed policymakers expect the economy to grow 5.9% in 2021 and 3.8% in 2022, a slightly weaker trajectory than it had forecast in June that factors in the impact of the coronavirus Delta variant on growth. The nation's unemployment rate, now at 5.2%, is projected to fall to 4.8% by year-end and continued falling to 3.8% in 2022.

At the same time, inflation has surged as resurgent consumer spending and disrupted supply chains have combined to create shortages of semiconductors, cars, furniture and electronics. Consumer prices, according to the Fed's preferred measure, rose 3.6% in July from a year ago — the sharpest such increase since 1991.

Powell said inflation is likely to remain elevated before declining closer to the Fed's 2% target as supply constraints in the U.S. recede. Labor demand remains healthy, he added, attributing a sharp decline in job growth last month to the pandemic.

"start" - Google News

September 23, 2021 at 06:38PM

https://ift.tt/3hZlKuN

Fed ready to start reeling in emergency stimulus measures as economy heals - CBS News

"start" - Google News

https://ift.tt/2yVRai7

https://ift.tt/2WhNuz0

Bagikan Berita Ini

0 Response to "Fed ready to start reeling in emergency stimulus measures as economy heals - CBS News"

Post a Comment