Venture capitalists are investing at the fastest pace in more than a decade, in a flurry of dealmaking that has intensified competition for stakes in young tech companies while increasing concerns about inflated valuations.

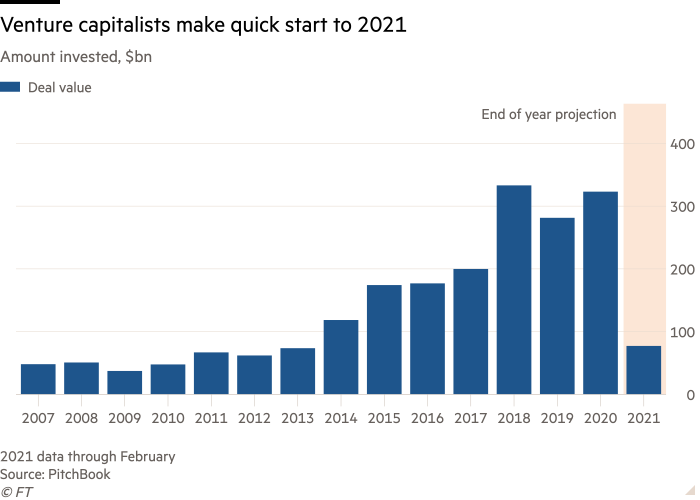

Investors were on course through February to plough more than $460bn into private start-ups this year, according to the data provider PitchBook, an almost 40 per cent increase from a recent peak in 2018.

The charge is being driven by large firms that invest in both private and public tech companies, with many venture capitalists naming Coatue Management and Tiger Global Management as examples.

Tiger Global, which manages $50bn in assets, has nearly doubled its pace of dealmaking from last year, making about one investment every two days, according to PitchBook data. Coatue backed 17 private financings during the same period, putting it on pace to top last year’s investment total by more than half.

“There’s a tremendous amount of competition,” said Arun Mathew, a partner at the venture capital firm Accel. “There’s just so much capital in the market at all stages.”

Venture capitalists said the market environment had increased the pressure to strike quick deals, especially in sectors that benefited from shifts in behaviour prompted by the pandemic, such as business software and ecommerce.

With some firms being willing to move quickly, other investors were being forced to speed up or miss out.

“You have to make a decision in the space of a week rather than a few weeks,” said Nicole Quinn, a partner at Lightspeed Venture Partners who focuses on consumer start-ups.

Optimistic investors said the pace reflected an expanding market opportunity for internet companies, with the pandemic accelerating the adoption of new technologies. A string of blockbuster public listings has also fuelled investor activity.

But some warned that start-ups in hot areas had received excessive valuations relative to their business progress, creating short-term risks if the companies did not live up to lofty expectations.

“Not every company can be Zoom or Snowflake,” Mathew said, referring to the video chat and data analytics groups whose valuations have soared during the pandemic. “Those are amazing companies . . . but they’re unique.”

Some of the most competitive financings have resulted in premium prices. Sequoia Capital, for example, is in talks to lead a round of funding in Benchling, a life sciences software provider, that would more than quadruple its valuation to about $4bn, said one person briefed on the deal.

Tiger Global has also indicated interest in backing the company at that price, which was about one-third higher than what some investors were willing to pay to lead the financing, the source said.

Benchling, which investors previously valued at $850m last year, declined to comment. Sequoia and Tiger Global declined to comment.

Tiger Global has led some of this year’s largest start-up deals, including a $450m round of funding that valued the payments company Checkout.com at $15bn.

Other investors have also marked up its recent bets. Hopin, a virtual events start-up, this month reached a valuation of almost $5.7bn just two years after its founding. The new financing came close to tripling the valuation it received in a round of funding Tiger Global helped lead four months ago.

The frenzied start to the year mirrored exuberance in other corners of the market, as homebound investors looked for opportunities that would emerge as winners from the pandemic.

Tiger Global told investors last month that the transition to remote work had allowed it to become “even more focused and effective” while “recapturing countless hours spent travelling and commuting”.

“We leveraged our insight and access and materially increased the number of world-class management teams with whom we interact,” Tiger Global wrote in a letter to investors, seen by the Financial Times.

Tiger Global said it expected to finalise a new private investing fund this month, a bit more than one year after it raised almost $3.8bn for its predecessor.

"start" - Google News

March 10, 2021 at 12:03PM

https://ift.tt/3t6m6Tm

Stampede for Silicon Valley start-ups sees VCs invest at fast pace - Financial Times

"start" - Google News

https://ift.tt/2yVRai7

https://ift.tt/2WhNuz0

Bagikan Berita Ini

0 Response to "Stampede for Silicon Valley start-ups sees VCs invest at fast pace - Financial Times"

Post a Comment