U.S. stocks jumped sharply on Monday in a broad-based rally as stocks tied to the economic reopening jumped on vaccine optimism, while tech names rebounded from steep losses last week.

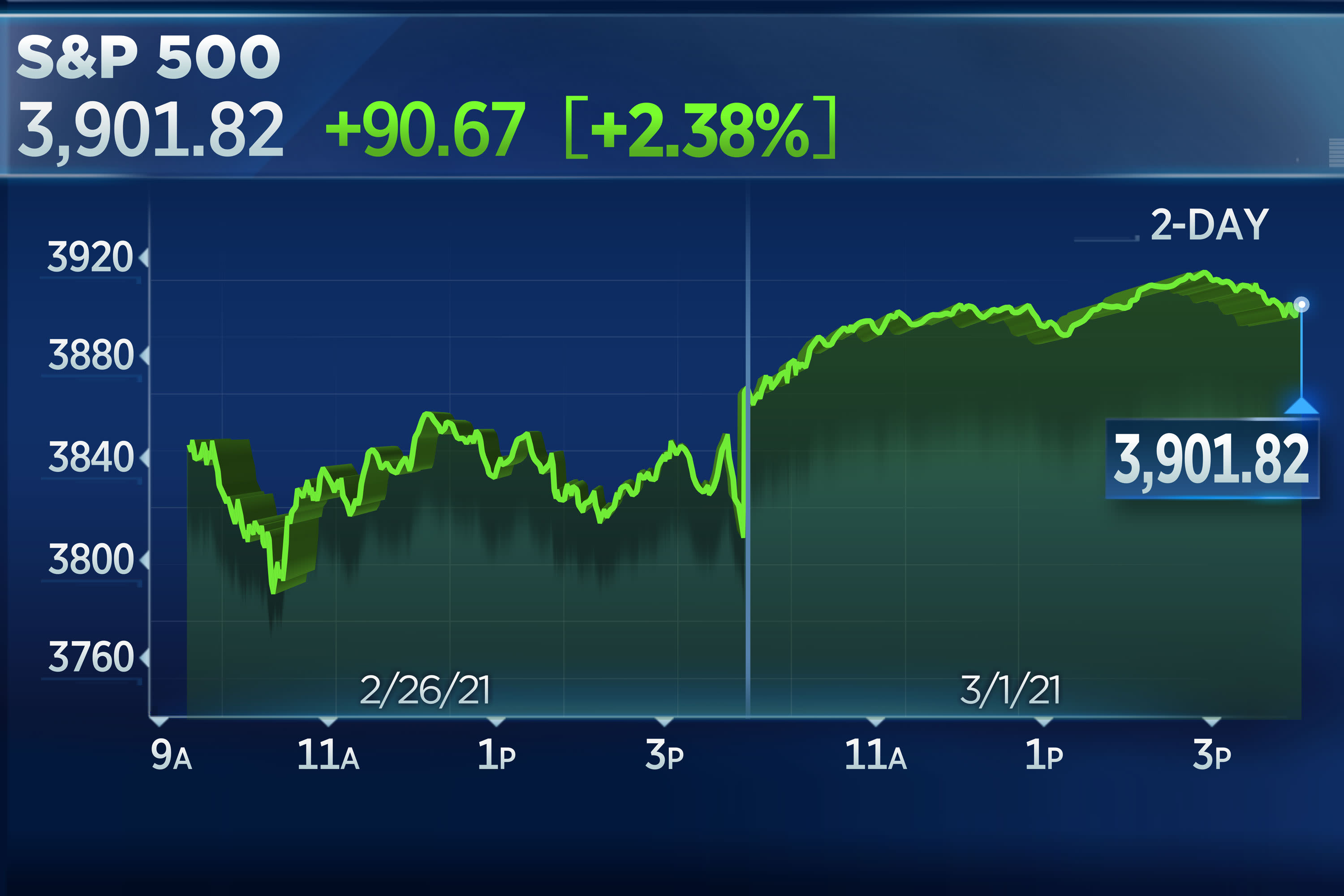

The 30-stock Dow Jones Industrial Average jumped 603.14 points, or 2%, to 31,535.51, boosted by a 5.8% jump in Boeing. The S&P 500 gained 2.4% to 3,901.82 as all 11 sectors registered gains, posting its best day since June 5. The tech-heavy Nasdaq Composite, which shed 4.9% last week, also popped 3% to 13,588.83.

Fewer than 40 stocks in the S&P 500 posted losses on Monday, the first trading session of March. At the Big Board, advancers outnumbered decliners by four-to-one. Energy and financials, which are popular cyclical plays, jumped more than 2.5% each amid optimism on vaccines. Meanwhile, high-growth tech shares outperformed as rates stabilized. Apple popped 5.4% and Tesla rose 6.4%.

The 10-year U.S. Treasury note yield dipped to a session low of 1.41% Monday before drifting back near the flatline. Yields appeared to be stable at these levels and the 10-year rate was off its high of 1.6% last week, which encouraged investors that the rapid rise in rates was at least slowing.

"Investors ask whether the level of rates is becoming a threat to equity valuations. Our answer is an emphatic 'no,'" David Kostin, Goldman Sachs' chief U.S. equity strategist, said in a note to clients. "Our bullish US equity view has already embedded expectations of rising interest rates."

Boosting sentiment on the vaccine front, the Centers for Disease Control and Prevention advisory panel voted unanimously Sunday to recommend the use of Johnson & Johnson's one-shot Covid-19 vaccine for people 18 years of age and older. The company expects to ship four millions doses initially.

A sudden spike in the benchmark 10-year note rate rattled stocks last week as rising rates can threaten the relative appeal of equities and compress stock valuation by reducing the value of future cash flows. Last week, the blue-chip Dow and S&P 500 lost 1.7% and 2.5%, respectively. The technology-heavy Nasdaq suffered its worst one-day sell-off since October on Thursday and posted its worst week since then by Friday's close.

"Equity investors are still looking at the rise in rates mostly as 'a good thing' and not yet as a threat notwithstanding some shaking of the tree in high multiple stocks and other parts of the market last week," said Peter Boockvar, chief investment officer at Bleakley Advisory Group. "The benefits of the vaccines vs the challenge of higher rates will be the theme this year."

On the stimulus front, the House passed a $1.9 trillion Covid relief bill, the American Rescue Plan Act of 2021, early Saturday. The Senate will now consider the legislation.

The major averages rose for the month of February, bolstered by a strong earnings season, positive news on the vaccine rollout and hopes of another stimulus package.

The Dow gained 3.2% for its third positive month in four in February. The S&P 500 advanced 2.6% and the Nasdaq rose nearly 1% for its fourth positive month in a row.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.

"start" - Google News

March 01, 2021 at 06:08AM

https://ift.tt/3aZROLZ

Stocks rocket higher in broad rally to start March, S&P 500 jumps 2% for best day since June - CNBC

"start" - Google News

https://ift.tt/2yVRai7

https://ift.tt/2WhNuz0

Bagikan Berita Ini

0 Response to "Stocks rocket higher in broad rally to start March, S&P 500 jumps 2% for best day since June - CNBC"

Post a Comment